🙃 Why the Fed Chair’s Decision Matters More Than Ever

There are many aspects, perspectives, political motivations and effects from the Fed Chair increasing or cutting rates. This newsletter in particular is going to focus on why America’s largest private equity firms are hounding Jerome Powell to lower rates and what is at stake regarding his upcoming decision. To best paint the picture of what’s going on with private equity, we will break this article down into 3 sections: leveraged buyouts, collateralized debt obligations, and adjustable loans.

1. Leveraged Buyouts

If private equity firms are looking to acquire a company, but want to limit their risk on their balance sheet, they will structure what is called a leveraged buyout. Leveraged buyouts are happening in America today and aren’t anything too new. A leveraged buyout means that the company that a private equity firm acquires assumes the loan that the private equity firm used to finance the company’s acquisition. Huh? Let’s use an example to break it down:

Example

Let’s say I'm private equity and let's say I want to buy this company for $100 million, but I don't want to risk much of my own money. What I'll do is I'll put in just $20 million of my own cash and borrow the other $80 million from the bank. Here's the catch - the company I'm buying is the one responsible for paying back that $80 million. Hey, I own them now, I make the rules and I tell them who pays what. The company acquired is now on the hook for the loan, not me.

Now if I really want to start abusing my leveraged buyout, I’ll start taking out more loans from the bank under the acquired company’s name, and use some creative financing to give myself fat bonuses. Let’s say the company takes out a second loan to pay me as a private equity owner, not even to improve the company or invest in capital. I can do that and label it as a special dividend. All legal, all fair. Just like that, boom, I already made money, the company has even more debt, and I only put up $20 million to begin with.

That's exactly what happened at Toys-R-Us in 2005. Private equity firms bought it, loaded it with debt, and made it borrow even more just to pay private equity $470 million in special dividends. Two years later, the company was spending over $400 million a year just on interest payments alone, and soon enough, never recovered. 33,000 people also lost their jobs.

2. Collateralized Debt Obligations

So these private equity firms are running around utilizing leveraged buyouts and special dividends to profit quickly from acquisitions. And you’re telling me the banks are cool with this? Why would a bank assume the loan in the first place if they knew that the private equity firms created a higher risk for default? Because the banks know how to bundle up the risky loan given for the private equity firm’s acquisition, and sell it to hedge funds. Similar to what happened in the 2008 Great Financial Crisis with mortgages, banks can take loans with varying degrees of risk and bundle them together so that they may not appear as risky. This is a collateralized debt obligation. So if the banks are financing a ton of risky loans to private equity firms looking to use leveraged buyouts, they might bundle in a few of these loans into a package with a bunch of safe bonds. Then they’ll step back and say ‘wow that whole package looks pretty safe’ completely disregarding the risky bonds associated within the bundle.

When Anthony Bourdain explained it in the Big Short movie, he explained it as taking the fresh fish he bought at the market on Friday and taking the old piece of the fish that couldn't sell, and instead of throwing it away, reselling it as fresh new fish Stew on Sunday.

Just because triple A, super safe loans say they are safe, does not necessarily mean that they are not connected to a risky bond currently being used today in a leveraged buyout.

3. Adjustable loans - Why the Fed’s decision matters

Up to this point we have discussed ‘the game’ being played by many large American private equity firms. Utilize a leveraged buyout to get rich, while the bank makes money hiding risky bonds and even selling some of those risky bonds to hedge funds. Got it. So long as not too many private equity firms get greedy and make too many businesses default we should be fine, and jobs should be safe.

Now here’s why the upcoming Fed decision matters. The Fed raised interest rates from 0% to around 6% over the last two years, and we're starting to see strain with companies that acquired companies during COVID times with adjustable rates. The adjustable rates that companies utilized during COVID meant that their monthly payments on their loans were not as high because interest rates were not as high. As you might have guessed, as interest rates go up, so do the adjustable rates utilized for acquisitions. So now, companies that used leveraged buyouts are like ‘woah even though I’m using the company’s money to pay back my loan, these payments are STEEP.’ As interest rates have risen, the debt that people took out during COVID utilizing adjustable rates has become more expensive.

Why the Fed’s Decision Matters

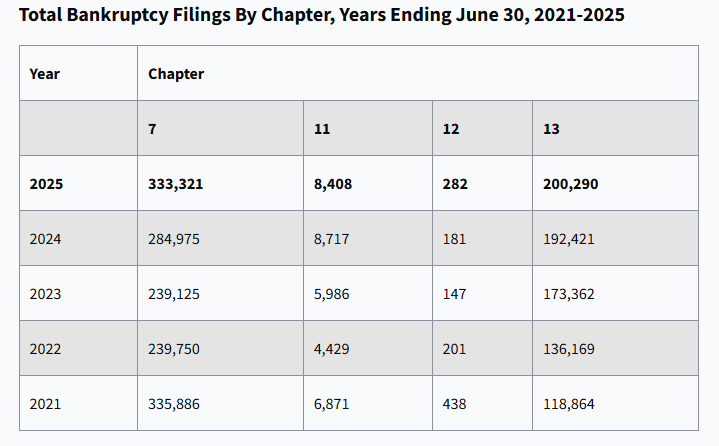

When you think about the magnitude of some of the private equity firms and the acquisitions they have closed over the last couple years, it’s easy to see why their parent firms are uneasy with the higher payments on their debt. Because it’s a ton of money! The last thing we want are acquired companies to default and declare for bankruptcy as a result of interest rates remaining high. Bankruptcies kill jobs, growth, bank credibility and industries. There are many view points to what the Fed should do regarding upcoming rate decisions. Some would argue protecting acquired businesses from bankruptcy to protect the bank’s loans might be a top priority. Others might point to inflation, or the labor market… but that’s a whole other can of worms!

Bankruptcy Filings Rise 11.5 Percent Over Previous Year. Published by UScourts.gov

Did You Know?

Before becoming the most powerful central banker in the world, Jerome Powell was actually a lawyer and private equity executive—he doesn’t have a Ph.D. in economics, which makes him the first Fed Chair in more than 40 years without a doctorate in economics. 🎓📉

Till next time,

Tax Hacks

The content provided in this newsletter is for informational purposes only and is not intended to be, and should not be construed as, professional tax, legal, or financial advice. While we strive to ensure accuracy, tax laws are complex and subject to change. Always consult with a qualified tax professional or financial advisor regarding your specific situation before making any decisions based on the information provided herein.